Green Climate Fund (GCF)

Overview of the Green Climate Fund (GCF)

- Fund to support mitigation and adaptation measures against climate change

- Aims to achieve a paradigm shift

- Established at the COP16 to the UNFCCC, with its permanent headquarters located at Songdo, Republic of Korea

- Board meetings are held at least twice a year (normally three times)

- Started project approvals from 2015; As of March 2018, 76 projects have been approved and total of 3.7 billion USD has been committed

- Accredited Entities (AE) play the central role in project implementation.

- Project + Programmes: https://www.greenclimate.fund/what-we-do/projects-programmes

- Portfolio Dashboard: https://www.greenclimate.fund/what-we-do/portfolio-dashboard

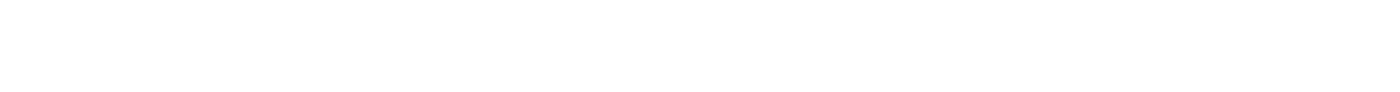

Strategic Prioritized Areas

Source: GCF secretariat

- The fund aims to achieve equal allocation of its resources towards mitigation and adaptation.

- At least half of the resources for adaptation are allocated to vulnerable countries, including Small Island Developing States (SIDS), Least Developed Countries (LDCs), and African States.

Portfolio of GCF Projects

Source: GCF in numbers

- In terms of the total requested funding, as well as the project/programme pipeline, the portfolio is well-balanced with high ratio of cross-cutting projects covering both mitigation and adaptation measures.

- The number of small-sized (10 Million USD - 50 Million USD) and medium-sized (50 Million USD - 250 Million USD) projects is high.

| Type of financial aid | Content | Breakdown of approved projects |

|---|---|---|

| Grant | Awarded to projects/programmes that truly require financial aid; the use of these resources is restricted to activities meeting the climate change measurement and development needs. | 43% |

| Loan | Offered with the right level of concessionality for the project target (Private, Public). | 43% |

| Guarantee | Offered to projects/entities to promote co-financing such as loan and equity. | 3% |

| Equity | Investments are made towards implementing entities to support the project. | 11% |

Source: GCF in numbers

Six Investment Criteria

Source: GCF

Access Modalities for GCF

Source: GCF

Funding Proposal Approval Process

Source: GCF

- AEs are responsible for developing and submitting funding proposals, and play a very important role in the proposal process.

- Proposals are improved through several rounds of exchanges with the GCF Secretariat. Some of the proposals submitted to the 18th Board meeting have been revised seven to eight times.

| Process | Content |

|---|---|

| 1. Generation of programme or project funding proposals | These documents are developed by AEs. After issuance of Non Objection Letters by the NDA, the proposals are submitted to the Secretariat, commented upon by the Independent Technical Advisory Panel (iTAP), and assessed by the Board. |

| 2. Concept Note (Voluntary) | Even though the submission of a concept note is not compulsory, it can be helpful for obtaining early feedbacks/recommendations from the Secretariat. |

| 3. Submission of funding proposals | Based on the funding proposals submitted, pre-screening comments are made, based on six investment criteria and the proposal's adequacy. |

| 4. Analysis and recommendations to the Board | Comments based on the six investment criteria are provided by the iTAP, and are later referred to by the Board during their assessment. |

| 5. Board's decision | Funding proposals that have been pre-screened are assessed for approval at Board meetings held three times a year. |

| 6. Legal arrangements for approved proposals | Legal agreements (contracts) on the approved financial aid are signed between project participants and the GCF Secretariat. |

National Designated Authority (NDA)

- To be able to access funding from the GCF, a developing country has to nominate an NDA or a Focal Point.

- The NDA/Focal Point will serve as an interface between its country and the GCF, and play an important role in coordinating GCF activities in the country.

- Among others, every funding proposal submitted to the GCF has to be no-objected by the NDA/Focal Point of the respective country, or countries in case of a regional project, to ensure compatibility of a project with relevant national policies and compliance with national environmental and social safeguard policies.

Accredited Entity (AE)

Source: GCF

Accredited Entities (AE)

- Access to the fund resources will be through AEs (e.g., national, regional, and international entities accredited by the Board).

- AEs can submit funding proposals to GCF.

- Once these funding proposals are approved by the Board, AEs will be entitled to receive GCF finance and coordinate the implementation of an approved project or programme.

- There are two modalities (direct access entities and international access entities) to access the fund

Direct Access Entities (DAE)

Recipient countries can nominate competent subnational, national, and regional implementing entities for accreditation to request, receive, and implement GCF funding. Enhancement of direct access is promoted by the Board to strengthen country ownership.

International Access Entities (IAE)

Recipient countries are also able to access the fund through accredited international entities, including United Nations agencies, multilateral development banks, international financial institutions, regional institutions, and entities registered and operating in countries that are not recipient/beneficiary countries.

Structure of the Funding Proposal

| Section | Contents |

|---|---|

| Section A | Project/Programme summary |

| Section B | Financing / Cost information |

| Section C | Detailed Project/Programme description |

| Section D | Rationale for GCF involvement |

| Section E | Expected performance against investment criteria |

| Section F | Appraisal summary |

| Section G | Risk Assessment and management |

| Section H | Result-based monitoring and reporting |

| Supporting documents | Annex |

- GCF Library: https://www.greenclimate.fund/library/-/docs/list/574044

- Green Climate Fund Proposal Toolkit 2017: Toolkit to develop a project proposal for the GCF

https://cdkn.org/wp-content/uploads/2017/06/GCF-project-development-manual.pdf

Contents of the Funding Proposal

| A.1. Brief Project/Programme Information | - |

|---|---|

| A.1.1. Project/programme title | Provide the full title of the proposed project/programme. |

| A.1.2. Project or programme | Indicate if the proposal is associated with a project or a programme. |

| A.1.3. Country (ies) / region | Enter the country (or countries) or region in which the proposed project/programme will be implemented. |

| A.1.4. National designated authority (ies) | Insert the name of the NDA |

| A.1.5. Accredited Entity | Insert the name of AE. |

| A.1.5.a. Access modality | Indicate which mode of access the entity is using to access the Fund's resources: direct or international |

| A.1.6. Executing entity / beneficiary | Insert the name of the EE(s) who will channel funds, execute, carry out or implement the funded activity under the overall management and supervision of the AE. |

|---|---|

| A.1.7. Project size category (Total investment, million USD) | Indicate the scale of intended activities for the proposed project/programme: Micro (≤10), Small (10<x≤50), Medium (50<x≤250), Large (>250) |

| A.1.8. Mitigation / adaptation focus | Indicate whether the proposed project/programme targets mitigation, adaptation, or cross-cutting (both mitigation and adaptation) |

| A.1.9. Date of submission | - |

| A.1.10. Project contact details | - |

| A.1.11. Results areas (mark all that apply) | Mark all the relevant result areas of the fund's initial RMF that are applicable to the proposed project/programme. |

| B.1. Description of Financial Elements of the Project/Programme | Provide a breakdown of cost estimates by major cost categories. Present a financial model that includes projections covering the period from financial closing through final maturity of the proposed GCF financing with detailed assumptions and rationales. Summarize the financial instrument(s) to be used in support of the project/programme, and how the choice of financial instrument(s) will overcome barriers and leverage additional public and/or private finances to achieve the project objectives. |

|---|---|

| B.2. Project Financing Information | State the amount of financial contributions needed for the proposed project/programme. The 'total project financing' should be the sum of 'requested GCF' amount and the 'co-financing' amount. Provide a breakdown by financial instrument. Provide strong economic and financial justification for the concessionality that GCF provides, particularly in the case of grants. Please note that the level of concessionality should correspond to the level of the proposal's expected performance against the investment criteria. |

| B.3.Financial Markets Overview (if applicable) | Provide an overview of the size of the total banking assets, debt capital markets, and equity capital markets, which could be tapped to finance the proposed project/programme. Also provide an overview of market rate, i.e., one-year Treasury bill, five-year government bond, five year cooperate bond (specify credit rating), and five-year syndicate loan. |

| C.1. Strategic Context | Describe relevant national, subnational, global, political, and/or economic factors that help to contextualize the proposal, including existing national and sector policies and strategies. |

|---|---|

| C.2. Project/Programme Objective against Baseline | Describe the baseline scenario (i.e. emission baseline, climate vulnerability baseline, key barriers, challenges, and/or policies), and the outcomes and the impact that the project/programme will aim to achieve in improving the baseline scenario. |

| C.3. Project/Programme Description | Describe the main activities and the planned measures of the project/programme according to each of its components. Provide information on how the activities are linked to objectives, outputs, and outcomes that the project/programme intends to achieve. |

| C.4. Background Information on Project/Programme Sponsor (Executing Entity) | Describe the quality of the management team, overall strategy and financial profile of the sponsor (EE) and how it will support the project/programme in terms of equity investment, management, operations, production, and marketing. |

| C.5. Market Overview (if applicable) | Describe the market for the product(s) or services including historical data and forecasts. Describe the competitive environment including the list of competitors with market shares and customer base and key differentiating factors (if applicable). Provide pricing structures, price controls, subsidies available, and government involvement (if any). |

| C.6. Regulation, Taxation, and Insurance (if applicable) | Provide details of government licenses or permits required for implementing and operating the project/programme, the issuing authority and the date of issue or expected date of issue. Describe applicable taxes and foreign exchange regulations and details on insurance policies related to the project/programme. |

| C.7. Institutional / Implementation Arrangements | Describe in detail the governance structure of the project/programme, including, but not limited to, the organization's structure, and role, and the responsibilities of the project/programme management unit, steering committee, Ees, and so on, as well as the flow of funds structure. |

| C.8. Timetable of Project/Programme Implementation | Provide a project/programme implementation timetable. |

| D.1. Value Added for GCF Involvement | Describe the value added by the fund's support and the project/programme's long-term sustainability after the fund's intervention. Provide a justification for the amount of funding requested and the financial instrument(s) proposed, in order to close the funding gap and bring the project/programme to fruition. In the case of grant funding without repayment contingency, present a convincing financial and/or economic argument to ensure that the fund maximizes its use of resources. |

|---|---|

| D.2. Exit Strategy | Explain how the project/programme sustainability will be ensured in the long run, after the project/programme is implemented with support from GCF and other sources. |

| E.1. Impact Potential | Specify the climate mitigation and/or adaptation impacts using the four core indicators provided in the fund's investment framework. |

|---|---|

| E.2. Paradigm Shift Potential | (1) Potential for scaling-up and replication (multiples of initial impact size) for both mitigation and adaptation; (2) potential for knowledge and learning; (3) contribution to the creation of an enabling environment; (4) contribution to regulatory frameworks and policies. |

| E.3. Sustainable Development Potential | Provide the expected environmental, social and health, and economic co-benefit. Also provide the gender-sensitive development impact, which will aim to reduce gender inequalities in climate change impacts. These co-benefits and wider positive impacts may be drawn from an economic analysis of the proposed activities and can be strengthened with more qualitative factors. |

| E.4. Needs of the Recipient | Describe the scale and intensity of vulnerability of the country and beneficiary groups and elaborate how the project/programme addresses the identified needs. |

| E.5. Country Ownership | Demonstrate the following factors, among others: (1) existence of a national climate strategy and coherence with existing plans and policies; (2) capacity of AEs or EEs to deliver; and (3) engagement with NDAs, civil society organizations, and other relevant stakeholders. |

| E.6. Efficiency and Effectiveness | Make the case for strong cost-effectiveness and financial soundness. |

GCF Handbook

GCF Handbook Administrative Guidelines on Procurement

Administrative Guidelines on Procurement Environmental and Social Policy

Environmental and Social Policy Indigenous Peoples Policy

Indigenous Peoples Policy Information Disclosure Policy

Information Disclosure Policy Guidelines for the Environmental and Social Screening of Activities Proposed under the Simplified Approval Process

Guidelines for the Environmental and Social Screening of Activities Proposed under the Simplified Approval Process Accessing the GCF Readiness and Preparatory Support Programme

Accessing the GCF Readiness and Preparatory Support Programme Private Sector Facility

Private Sector Facility Mainstreaming Gender in Green Climate Fund Projects

Mainstreaming Gender in Green Climate Fund Projects How to access the Green Climate Fund for the private sector

How to access the Green Climate Fund for the private sector